How to Determine your Current Financial Situation (PLAN phase, CLARIFY step)

Clarity. Transparency. These are real benefits when it comes to personal finance. I’m sure you have a financial story, which means you own something or owe something (or both). The beginning of your money management journey is right where you are now. What is your current financial situation?

If you want to actively manage your personal finances, you need numbers. You may like the results of your financial status, or you may not. Either way, numbers give you the clarity and precision you need to make decisions. And even if some numbers are educated guesses based on fuzzy assumptions, it is still better than flying blind and being hit hard by reality.

Personal Balance Sheet for your Financial Overview

To create real clarity and transparency, we need structure. Companies have been doing it successfully for decades, and we can adopt the concept of a balance sheet for our needs. It’s pretty simple. The personal balance sheet has a left side and a right side. On the left are all the things you own. The right side is where the money came from. That’s it.

The entries on the left side are what accountants call “assets”. The entries on the right side are called “liabilities”. These are just the names for entries on the respective sides of the balance sheet. Let’s take a closer look at each side.

Assets on the Left Side

On the left side, you list everything you own that has an economic value and is relevant to your personal finances. Here are some examples.

- The house you live in is a real asset if you own it. It doesn’t matter if you still have a mortgage or other loans to pay off. We’ll get to that later when we talk about liabilities on the right side of the sheet.

- Your condo that you rent out is another major asset. Do you have a mortgage to pay off as well? Again, we will address that below.

- If you have a vacation home in a nice location, put it on the list as an asset. The location is not so nice anymore? Makes no difference, just add it to the list.

- Finally, there are the obvious financial assets like stocks, mutual funds, or cash. They also go on the list.

Next, let’s look at some examples that might be questionable. Some things certainly have value for you. But sometimes it’s more of an emotional value than an economic value.

- Perhaps you own some jewelry. If it’s made of gold, silver, and real gems, it could potentially be sold for a lot of money (just in case you ever wanted to). In that case, you should put it on the list. On the other hand, the chunky ring that belonged to your late favorite Aunt Hazel could be very valuable to you. However, if the ring would only fetch 30 Euros if you sold it, and you never want to sell it anyway, then it doesn’t belong on the list.

- Sometimes there are stamp collections, old Disney comics, or other things lying around in the attic. If these collectibles could be sold, they possess economic value and belong on your list of assets. If those Disney comics from your youth are dog-eared and stained, they might be better off in the trash.

- Laphroaig is a great Scotch whisky. The rest in a half-full bottle is still a pleasure, but certainly not a personal balance sheet item. On the other hand, if you have a case of 12 full bottles in your basement, you can put it on your assets list (unless you want to keep it for yourself for tough times to come).

- You’ve decorated and furnished your home beautifully. Unfortunately, these items lose most of their value the moment you buy them. Trying to sell used furniture is a sobering experience. These are usually not items that belong on your list of assets.

Let us now turn to the liabilities on the other side.

Liabilities on the Right Side

On the right side, you write down everything you owe to someone. This means that you already know today that you will, or at least should, pay money to another person or organization in the future. Here are some typical examples.

- If you’ve ever bought a house, you probably took out a mortgage to pay for it. This is a common example of long-term debt that can take decades to pay off in full.

- You may have been in a situation where you needed to replace your car after an accident. Unfortunately, you didn’t have the money to pay for it, and you needed to get to work somehow. Hence, you took out a loan, which goes on your list of liabilities.

- Credit cards can be tempting when you want to treat yourself. You now pay off the amount in monthly installments. Such credit card debt is a liability and will be added to the list unless the outstanding amount is paid in full in the next few days.

- You are worried about an additional tax bill due in a few months. Surely add this to your list of liabilities. After all, you already know about it, even though the amount is not yet due.

If the debt is for a relatively small amount, or the anticipated expense is a regular cost of living, then it does not belong on the liabilities list.

- You left your wallet at home and borrowed 50 EUR from a friend. This is of course a debt. However, I assume that you will return the money to your friend as soon as possible if you value your friendship. It shouldn’t go on the list.

- Some time ago you joined the local pigeon fanciers’ club. The club charges an annual fee, which you have to pay for as long as you remain a member. Such fees and dues are more like normal living expenses and do not belong on the list of liabilities.

Now that we know what the personal balance sheet, assets and liabilities are all about, let’s take a look at how to proceed.

Simple Level

You have probably already thought about your own situation when looking at the examples of assets and liabilities. Some of the examples may apply to you, and others may remind you of similar things in your life.

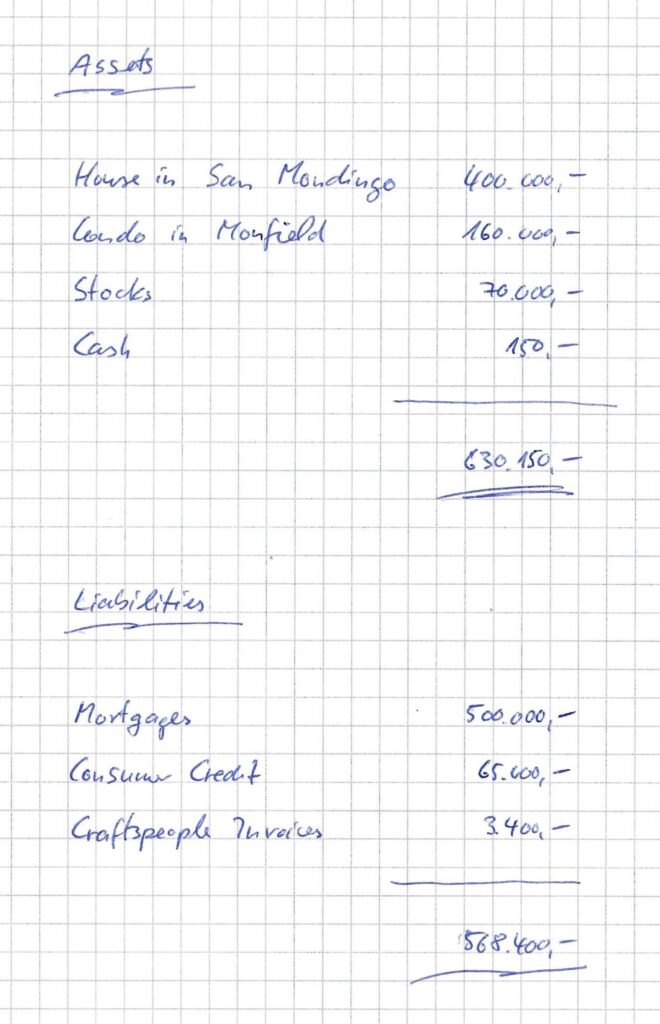

Take a few minutes to think about what comes to mind about assets and liabilities in your current situation. For each item, write down a name (House in San Mondingo) and an estimated value (400.000 EUR). And do it for both assets and liabilities.

Some items are quick and easy to value. For example, you can check the status of your current accounts or deposits online. For other items, such as the house in San Mondingo, you will need to make an estimate. The important thing is that every item has a value, however you arrive at it. And it could look like this.

That’s all for the simple level. At the intermediate level, we’re going to create a structured view that looks more like a corporate balance sheet. It provides a more detailed overview of your finances and is still quite easy to create. Therefore, let’s take a brief look at the structure of such a balance sheet.

Enhanced Structure for the Personal Balance Sheet

We adopted the idea of the balance sheet from companies and simplified it considerably. Now let’s bring back two structural elements which have been neglected above: the order of the entries and your net worth known as equity. In addition, we will now store the information in a spreadsheet to our convenience. Let us introduce the changes one by one.

The Type of Items

First comes s small change with the entries. Each one has…

- …a name, e.g. “House in San Mondingo, 11 Meadows Drive” or “Dental bill of Dr. Drillenburger”.

- …a type, such as “Real Estate” or “Current Liabilities”.

- …a value, such as the estimated value of the house or the amount of the bill.

The name and value have been there before. We now add the type to make the personal balance sheet more organized by grouping items of the same type together. It’s like organizing your pantry. You might put apples and pears on the “fruit” shelf, while Leffe and Laphroaig go on the “liquor” shelf. The groups on the balance sheet are named differently, of course.

Structure of the Assets List

We define three groups of assets on the left side of the balance sheet:

- Financial assets include cash and everything in a bank account. This includes call deposits and fixed-term deposits, for instance.

- Tangible assets include most things that can be touched. Obvious examples are cars or real estate.

- Investment assets include investments in securities and precious metals, as well as government and private insurance policies. Examples include stocks, gold bars, government pensions or life insurances.

You might say that gold bars clearly are tangible. That’s true. However, it’s common practice to assign precious metals – either physical or virtual (securities) – to the “investment assets” group, while jewelry would go to the “tangible assets” group. Unfortunately, I can’t come up with a brilliant explanation here; it’s just common practice.

Within each group, items are ordered by the time it would likely take to convert them to cash or cash-like money in the bank. In the case of financial assets, cash comes first, and the long-term time deposits come last. For physical assets, a car is likely to turn into cash more quickly than real estate, and so on. Please don’t try too hard to get it perfect. The easiest way is to stick with a sample balance sheet like the one below.

There are 2 advantages to this structure. First, it’s easy to find certain things on your personal balance sheet. If you want to know about real estate, you will find it at the bottom of the “tangible assets” group. And second, it’s exactly the format that people at the bank or other financial institutions would expect. If you ever needed to talk to them, then you are already well prepared.

Structure of the Liabilities List

The grouping of liabilities is somewhat different. They are not grouped by type but rather by the time it will take to repay them. This results in only two groups.

- Current liabilities include anything that will be repaid within one year or less. Examples include medical bills, back taxes, and credit card debt.

- Long-term liabilities are anything that will be paid off over several years. Typical examples are car loans and mortgages. By the way, these liabilities are still typed as long-term even when they are nearing the end of their term.

In each group, liabilities with a shorter term or lower amounts can be placed near the top. Those with a longer term or higher amount should be placed near the bottom. When in doubt, use the example as a guide.

Equity or Net Worth

On a balance sheet for a company, the amount on the left and the amount on the right are equal. This is not yet the case with your personal balance sheet, because you probably have more assets on the left side than liabilities on the right. The difference is your net worth, which accountants call “equity”.

Imagine selling all your possessions on the left side of the balance sheet. Your house, your car, your beloved box of Laphroaig, all gone. Then you would pay off all the debts on the right side in one go, and after that, you would be debt-free. The money left in your wallet and bank account is your net worth. This is what you really own. Therefore, your net worth is the amount of money that would be left after paying off all your debts – theoretically.

Net worth is listed on the right side to equal the sum of the left side (assets) and the right side (liabilities plus net worth). It also makes logical sense if you think back to the picture above. The left side collects what you own. The right side shows where you got the money from – whether it’s a loan, a mortgage, or really your own money. Now it all comes together. This is your complete personal balance sheet. It’s as simple as that.

Intermediate Level

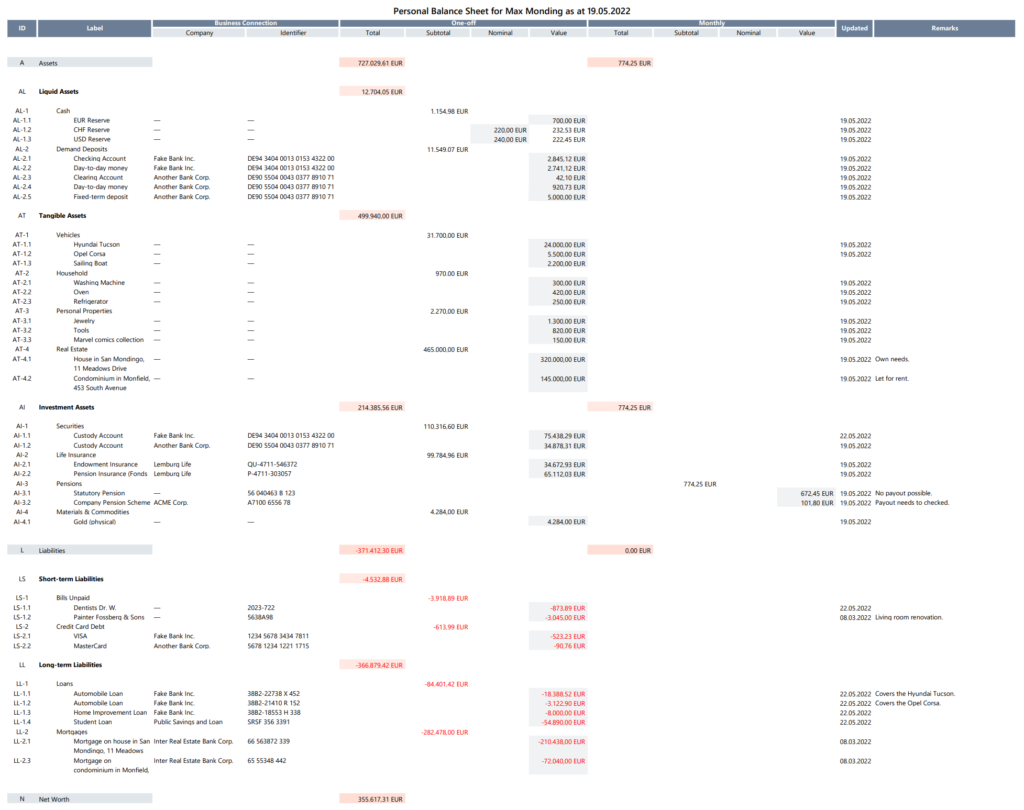

On this level, record your assets and liabilities on your personal balance sheet as explained above. There’s a template in Excel that you can download and use to make it as fast and simple as possible.

Go through all the things you own and consider them as assets. If you decide to put them on your list, then determine the type and current value whenever possible. The balance of your online bank account, the current stock price, or the latest letter from your pension company provide useful information. In the case of real estate, you can look up the price of comparable houses or apartments on the Internet. You will still have to estimate the price of your house or condo, but at least you have some idea about the real estate market.

The same goes for liabilities. You can check your credit card debt or mortgage balance online. Some lenders will send you a current credit status once a year. In general, there is little need to estimate liabilities or debts. You can usually figure out these numbers with very little effort because your lenders will usually track it and tell you precisely. Here is an example of what a personal balance sheet might look like. Despite debts of more than half a million, it shows a net worth of 355.617,31 EUR. Impressive!

Comprehensive level

The personal balance sheet shows a complete picture of your current financial situation in terms of assets and liabilities. However, when thinking about life’s goals, protection against life’s risks is often included. This is where insurance comes in, and I have not yet considered it here.

In the future, the gap will be closed. The comprehensive level will keep the personal balance sheet as before and add insurance to create a comprehensive personal financial perspective in every respect.

Conclusion

Now you know exactly where you stand financially, and that in itself can be interesting and sometimes sobering. And it’s a necessity when it comes to taking action, because your personal balance sheet gives you a clear and precise reference point against which to monitor your future development. How are your assets, liabilities and especially your net worth changing? Is everything going as you had hoped and planned? Now you can make that assessment based on numbers and facts.